Speedchain, an Atlanta-based startup providing commercial card programs to the construction industry, recently announced it closed $111 million in outside capital to grow its FinTech platform.

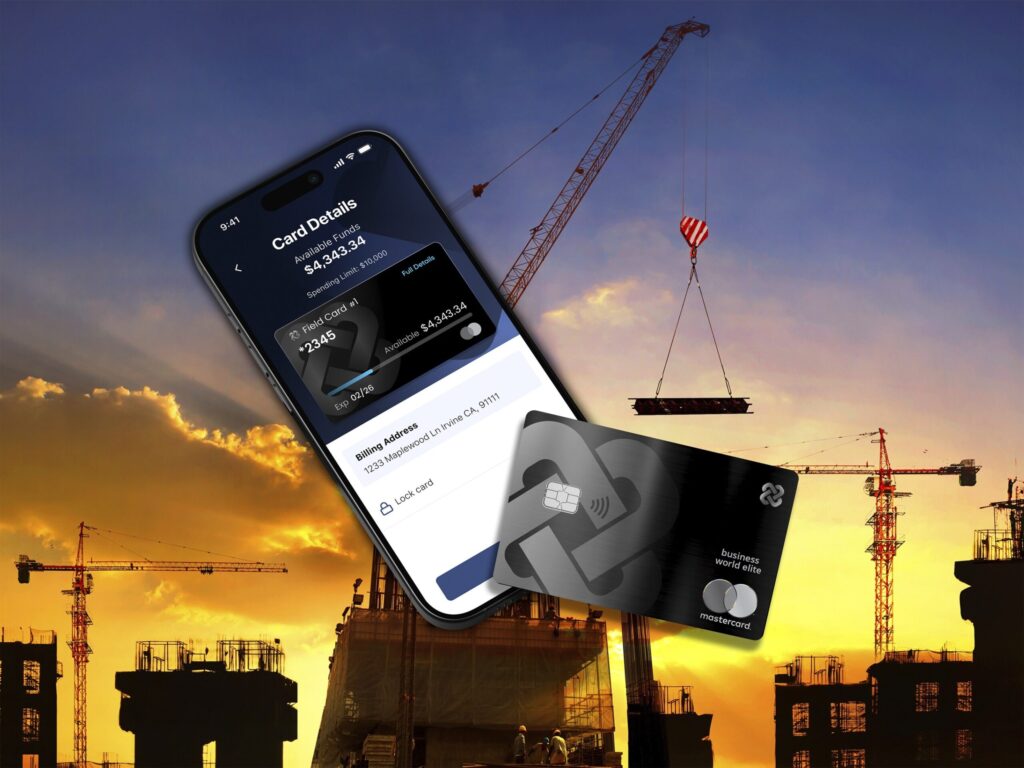

The startup, which Hypepotamus covered in 2024, is led by CEO Daniel Cage. Since Hypepotamus last spoke to the Speedchain team, the startup’s product has evolved significantly over the last year, specifically enhancing its receipt management and export functions to help field and finance teams alike. The startup has also become the construction card solution for AGC, the largest national association for contractors.

“Beyond that Speedchain has built enhanced approval flows so that the right PM or super on the job can approve transactions while tracking towards a monthly budget,” the team told Hypepotamus.

About The Funding Round

The $111 million was a mix of equity and debt financing. The exact mix of the two was not disclosed.

The debt financing came from Community Investment Management (CIM), a private credit impact investment manager based in San Francisco. Cage told Hypepotamus that the debt financing part of the round will help fuel Speedchain’s lending side of the business.

Equity investors in the round included Arizona-based GTM Fund, San Francisco-based Village Global, Atlanta-based TTV Capital, San Francisco-based K5 Global, Utah-based Tandem Ventures, and New York-based Emigrant Bank.

Fueling What’s Next For Speedchain

Team currently has just under 40 employees, with open engineering, finance, marketing, and sales roles currently listed on their website. The team is mainly concentrated in Atlanta and works out of the startup’s Midtown office. Cage said that Speedchain has a “great pipeline” of engineering talent coming from Georgia Tech.